At ABU public lecture, former CBN chief says Nigeria is Africa’s top crypto economy with 22 million users

Former Deputy Governor of the Central Bank of Nigeria (CBN) Suleiman Barau says Nigeria is Africa’s top crypto economy with a nine percent year-on-year growth in the volume of crypto transactions.

According to him, the crypto penetration rate in Nigeria was predicted to increase by an average of 2.4 percent annually between 2024 and 2027.

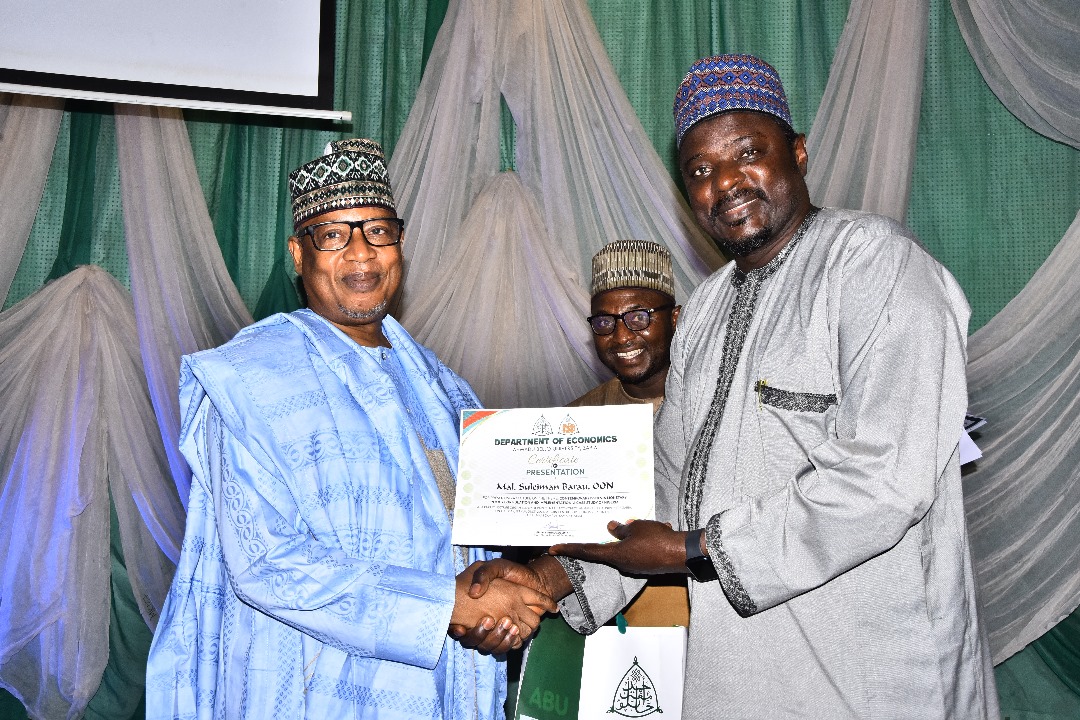

Barau, an alumnus of the Department of Economics, Ahmadu Bello University, spoke as a guest speaker at a public lecture held in Zaria today – Tuesday, 12th August, 2025.

‘Contemporary Issues in Monetary Policy Formulation and Implementation: A Case Study of Nigeria’ was the theme of the lecture.

The lecture, which took place at the CBN Centre for Economics and Finance, was put together by the Department of Economics, Ahmadu Bello University, Zaria.

The former CBN chief, who took a look at rising level of crypto assets in monetary space, explained that digitalisation had undoubtedly transformed the financial and monetary landscape globally.

He said by the first half of 2023, estimated crypto users stood at 420 million worldwide, with 38 million of the users in Africa, and 22 million out of the 38 million African users were Nigerians.

The distinguished ABU alumnus said despite the obvious enhanced traction of crypto assets, it clearly appeared the sentiment of the monetary authorities was skewed against formal recognition of crypto assets.

“For example, the CBN in 2017 issued a directive to commercial banks, warning them of the risks associated with virtual currencies.

“On the contrary, the Nigeria Securities Exchange (SEC) issued regulatory incubation guidelines for virtual asset providers”, he said.

Barau pointed out that this created uncertainty in policy space with dire implications for planning and investments.

The bank chief went further to explain that the growing trend in crypto assets might impact on monetary policy in several ways.

“First, it would alter the bank’s (CBN’s) projection on aggregate money supply which would transmit to the spectrum of interest rates within the economy.

“Secondly, there is the risk of currency substitution. Generally, currency substitution takes place in an environment with weak monetary policy frameworks and unstable currencies.

“Thirdly, the borderless nature of crypto assets raises concerns about capital flows and monetary stability in Nigeria,” he also said.

He further said given that crypto assets could facilitate cross-border transactions and investments without the need for for intermediaries, it heightened the risk of capital flight and speculative investment behaviour.

Barau, however, suggested that the CBN should migrate from being reactive to being proactive in order to manage liquidity from fiscal operations, particularly FAAC releases.

He also called for improved interface between fiscal and monetary authorities which he said was very critical in achieving price stability.

The CBN, according to him, needed to continue to protect its independence through better communication with all stakeholders and be seen by operators as the initiator and owner of its policies.

The guest speaker finally expressed confidence that the apex bank was equipped to continue to deliver on its mandate in spite of the challenges enumerated.

………………………………

Public Affairs Directorate,

Office of the Vice-Chancellor,

Ahmadu Bello University, Zaria (NAM)

Tuesday, 12th August, 2025